UAE Tax System Gets an Upgrade with New E-Invoicing Initiative by Ministry of Finance

The UAE Ministry of Finance is modernizing its tax infrastructure with the launch of a new electronic invoicing (eInvoicing) system. This eInvoicing system enables the seamless exchange of invoice documents between suppliers and buyers in a structured electronic format, allowing for automated processing. By introducing this initiative, the UAE aims to support a more efficient and digitally-enabled economy while boosting compliance and tax revenue collection.

Objectives of the UAE eInvoicing System

The UAE’s eInvoicing initiative has several key objectives:

- Supporting Economic Growth: eInvoicing contributes to economic competitiveness, leveraging big data for strategic insights.

- Digital Transformation: By reducing manual processes, the initiative aligns with the UAE’s vision for a fully digital fiscal ecosystem.

- Transparency and Compliance: The system offers improved transparency, enhanced audit capabilities, and increased compliance.

- Improving Taxpayer Experience: The new system is intended to streamline and enhance taxpayer and user experiences.

- Operational Efficiency: eInvoicing aims to optimize operational costs, reduce processing times, minimize paper use, support sustainability goals, while maximizing revenue collection for the Federal Government.

- Enhancing Compliance: By increasing compliance and combating the shadow economy, the system aims to close tax gaps and strengthen revenue collection.

Steps for Businesses in the UAE:

- Accredited Service Providers (ASPs): Once the list of ASPs is published by the Ministry of Finance, businesses are required to engage one to issue and receive eInvoices. Only ASPs will be authorized to exchange and report invoices in the UAE.

- Data Compliance: Businesses must align their invoicing data with the UAE data dictionary to ensure compliance.

- Integration: Companies must set up systems to exchange invoices electronically, which ASPs will validate, converting data into XML format and transmitting it to the buyer. ASPs also report invoice data directly to the Federal Tax Authority (FTA).

- Identification and Directory: Businesses will use their Tax Identification Number (TIN)—the first 10 digits of their Tax Registration Number (TRN)—for eInvoicing purposes. Businesses without a TRN will need to register with the FTA to receive a TIN. All eInvoicing-enabled businesses will be listed in the Peppol directory, accessible through the Federal Tax Authority and Ministry of Finance websites.

The UAE eInvoicing Model

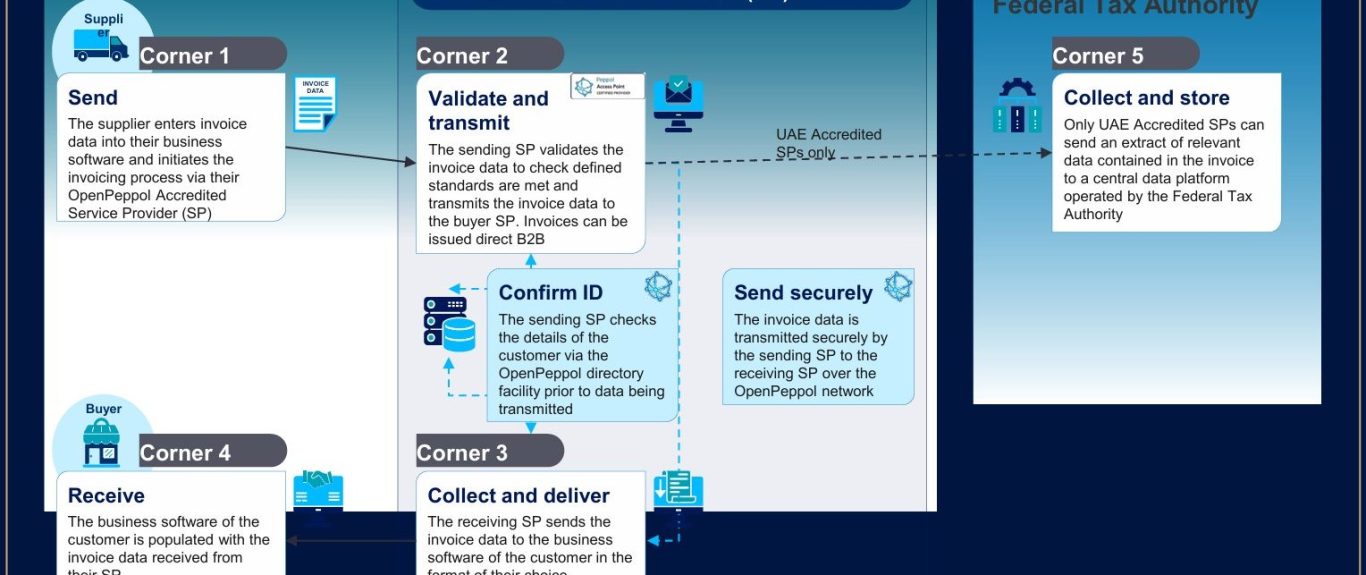

The UAE’s eInvoicing model follows a "Decentralized Continuous Transaction Control and Exchange" (DCTCE) or 5-corner approach, which involves multiple stakeholders, including the seller, buyer, and an Accredited Service Provider (ASP). Each ASP facilitates the exchange and reporting of invoices within the Peppol network, which is a standardized network for electronic documents.

Key Model Components:

- Exchange and Reporting: The ASP will validate invoice data according to the UAE data dictionary and then exchange it over the Peppol network. Subsequently, all tax data fields in the invoice are reported to the FTA’s system (designated as “Corner 5” in the model).

- Interfaces: The connection between different system components is regulated depending on the stage:

- C1 to C2 and C3 to C4: Not regulated by MoF/FTA, relying on API, web interfaces, or SFTP/ETL methods.

- C2 to C3: Managed by Peppol with the AS4 protocol.

- C2 to C5: Regulated by MoF/FTA and will use an API for reporting purposes.

Source: MOF UAE eInvoicing Programme

Implementation Timeline

The eInvoicing system rollout will follow a phased timeline:

- Q4 2024: Finalize Service Provider (SP) accreditation requirements and complete the UAE Data Dictionary.

- Q2 2025: Issue the eInvoicing legislation.

- July 2026: Phase 1 Go-Live for reporting.

The UAE’s new eInvoicing initiative represents a significant step toward digital transformation, enhancing transparency, compliance, and operational efficiency in the nation’s tax system. With its structured rollout, the eInvoicing system is expected to streamline tax processes, create a fair business environment, and support the UAE’s commitment to innovation and sustainable economic growth.

Source: EInvoicing – Ministry of Finance – United Arab Emirates

Join the MB&A CPAs Community:

Stay connected with MB&A CPAs on social media through linkedin, facebook, instagram, twitter, tiktok, and youtube for the latest updates on industry trends, financial insights, and upcoming events.

Together, we can build a brighter future with accurate and insightful information.

Related Contents

© Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.